About us

Overview

Nexos Technologies Inc is a highly specialized software engineering firm focused on developing real-time payment applications and gateways to support the emerging digital asset and tokenization industry sectors.

Nexos team has over thirty years of banking and capital markets technology experience designing, developing and maintaining mission critical financial applications that have processed over $100 billion of transaction volume.

Systems Deployment

Nexos launched its first commercial deployment in 2021, offering payment and banking services with its banking partners to individuals and businesses nationwide. Nexos systems can be deployed regionally or globally in the U.S., Europe and Asia.

Nexos is headquartered in Stamford CT and New York with resource centers located globally servicing customers across the U.S., Europe and Latin America.

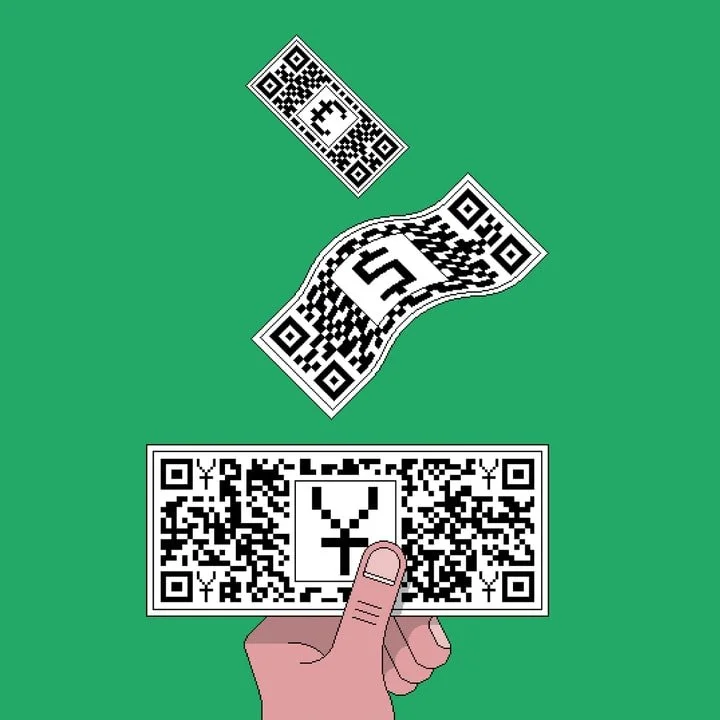

Cashless Design

The world is rapidly moving beyond cash and physical branches to conduct transactions and interact with banking functionalities. The mobile phone and the always-on, always-available internet culture are driving innovation in cloud computing and infrastructure. These secular trends are fundamentally changing how banking and payments are conducted The benefits of moving towards a real-time, frictionless, data-first payments framework are many, including:

Increasing innovation

Lowering costs

Increasing financial inclusion

Faster times to market

Faster prototyping and innovation

Increasing competition

Increasing convenience

Special Report - the Economist on digital cash - the changing era in payments.